President Trump on Thursday signed a bipartisan bill to loosen key portions of the Dodd-Frank Act of 2010, cementing the first major changes to Pr

— Read on thehill.com/policy/finance/389212-trump-signs-dodd-frank-rollback

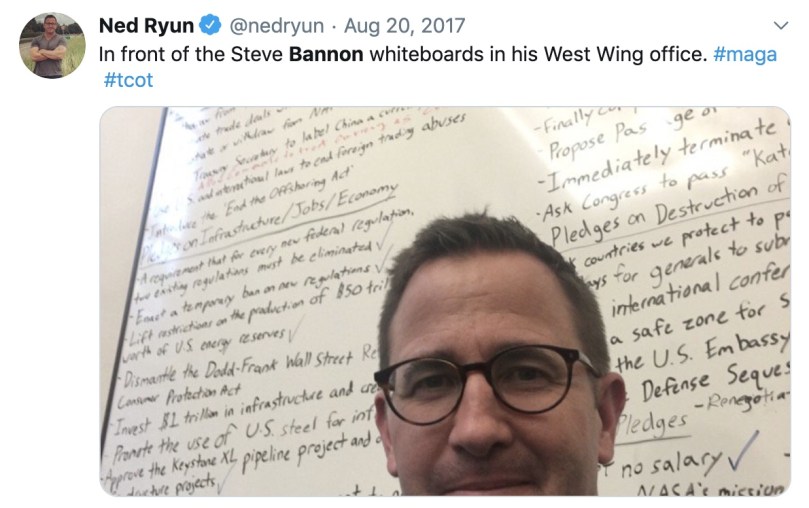

Bannon’s whiteboard says, “dismantle Dodd-Frank.” How does this help the working class?!

Bannon’s whiteboard says, “dismantle Dodd-Frank.” How does this help the working class?!The final compromise leaves most of Dodd-Frank in place, but provides a major boost for some of the largest U.S. banks. The measure releases of regional banks from tighter regulation by raising the threshold for closer Fed oversight from $50 billion to $250 billion in assets.

Banks below the new threshold will no longer be automatically subject to annual Fed stress tests and capital buffers meant to protect large firms are from severe financial crises.

Those banks are also no longer required to from submit for Fed approval a “living will” that outlines how a bank’s assets could be liquidated upon the firm’s failure without causing a widespread meltdown.

The bill includes several provisions to scrap rules for community banks and credit unions. Firms that hold 500 or fewer mortgages a year will no longer have to report some home loan data to federal regulators under anti-discrimination laws.

The bill also broadens the definition of qualified mortgages for smaller firms and exempts banks and credit unions with less than $10 billion in assets from the Volcker Rule, which bans firms from making risky bets with their own assets.

You must be logged in to post a comment.