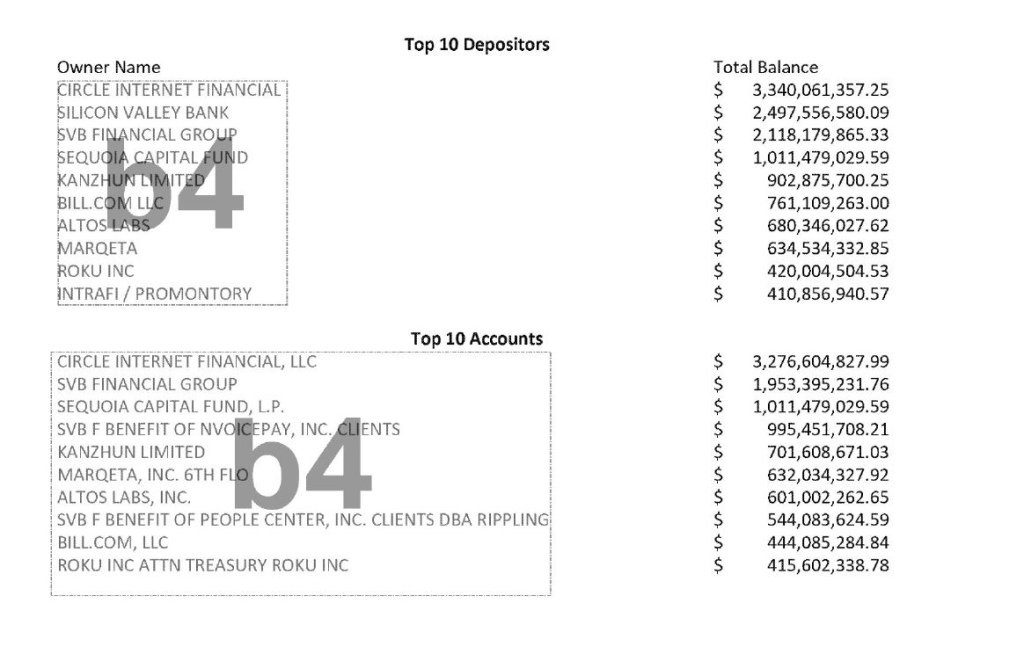

(Bloomberg) — When federal regulators stepped in to backstop all of Silicon Valley Bank’s deposits, they saved thousands of small tech startups and prevented what could have been a catastrophic blow to a sector that relied heavily on the lender.

Big VC, Tech Got Backstop for Billions in Uninsured SVB Deposits (archived)

You must be logged in to post a comment.