Two Fed-Supervised Banks Blew Up Last Week; Two More Dropped Over 40 Percent Yesterday; and the Fed Wants to Investigate Itself — Again

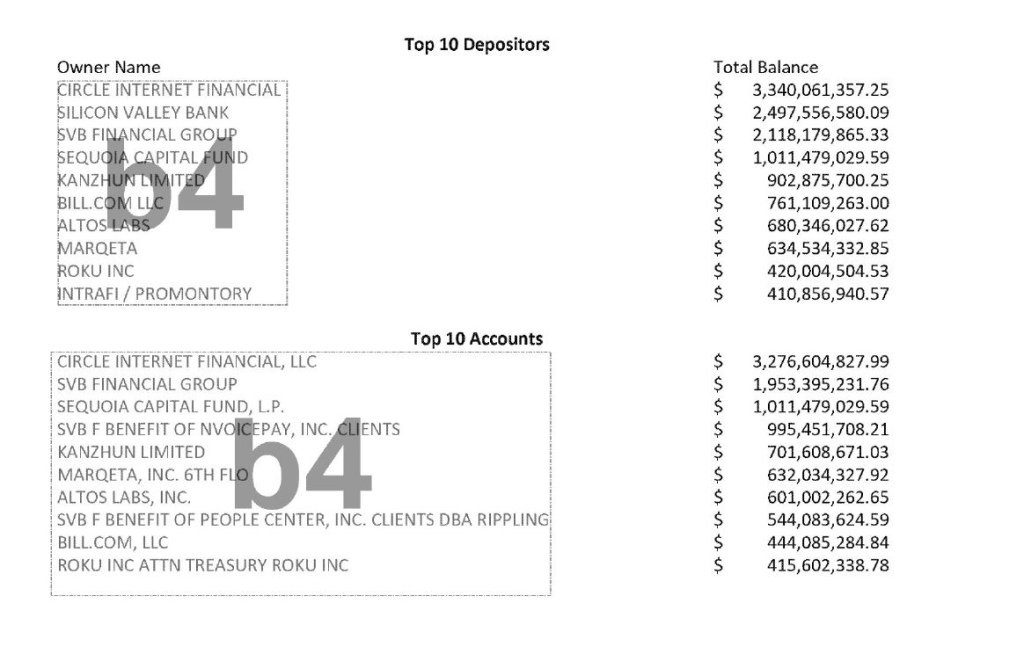

Last Friday, California state regulators closed Silicon Valley Bank and the Federal Deposit Insurance Corporation (FDIC) became the receiver. Its stock price had lost over 80 percent of its market value over the prior year; $150 billion of its $175 billion in deposits were uninsured, either because they exceeded the $250,000 FDIC cap and/or they were foreign deposits. The bank was effectively operating as a Wall Street IPO pipeline in drag as a federally-insured bank. The Federal Home Loan Bank of San Francisco had quietly been bailing it out – to the tune of $15 billion. Oh – and by the way – its primary regulator was the Federal Reserve Bank of San Francisco. And while all of this hubris was occurring, the CEO of Silicon Valley Bank, Gregory Becker, was sitting on the Board of Directors of his regulator, the Federal Reserve Bank of San Francisco.

…

Oh, and by the way, the Fed member banks in each of the 12 Federal Reserve Districts that can choose to be regulated by the Fed, literally own their regulator. That’s right, they own the stock in their regional Fed bank, which is a private institution, unlike the Federal Reserve in Washington, D.C. which is an “independent” federal agency. (See, for example, These Are the Banks that Own the New York Fed and Its Money Button.)

…

Adding to the ongoing arrogance of the Fed, its Chairman, Jerome Powell, released a statement two minutes after the market closed yesterday, stating that “The events surrounding Silicon Valley Bank demand a thorough, transparent, and swift review…” So, once again, it’s decided to investigate itself. The Fed’s Vice Chairman for Supervision, Michael Barr, will oversee the investigation.

You must be logged in to post a comment.