Massive US Oil Caverns Sit Empty and Will Take Years to Refill

- Nation’s oil reserve is at 40-year-low after historic drawdown

- Experts say refilling will take decades, if it happens at all

Massive US Oil Caverns Sit Empty and Will Take Years to Refill

- Nation’s oil reserve is at 40-year-low after historic drawdown

- Experts say refilling will take decades, if it happens at all

The House of Representatives is discussing a move that would effectively amount to an act of war if carried out: a naval blockade on China.

House Republicans Propose The Study Of An Oil Naval Blockade Of China

The following is outdated, especially considering the problems with the US Navy’s LCS ships, but I thought that the bold quote was interesting. I highly doubt that Russia would ever submit to the US!

Related:

[2013] Stranglehold: The Context, Conduct and Consequences of an American Naval Blockade of China

In short, Russia would not only be China’s best hope of overcoming an American blockade, but it would also be the United States’ key to closing China’s transit route through Central Asia and preventing China’s two neighboring oil producers from supplying it with petroleum. In an American blockade of China, Russia’s importance as a swing state cannot be overstated, as is borne out by the observation that “no blockade of China in history has succeeded without Russian acquiescence.”

Oil Falls Further On EIA Inventory Report

The Department of Energy provided some support for prices with an update from Energy Secretary Granholm, who said the department still planned to begin refilling the strategic petroleum reserve later this year, although she did not provide any specifics.

The United States seized an Iranian oil tanker just days before Tehran detained a tanker carrying American cargo in the Gulf of Oman, Reuters reported on Saturday.

US seized Iranian tanker days before Tehran captured US ship

U.S. To Refill SPR This Year If Advantageous

Granholm said on Wednesday that the United States couldn’t repurchase crude oil for the SPR and sell crude oil out of the SPR at the same time. The DoE is actively selling crude oil from the SPR as part of a congressional mandate that will see another 26 million barrels leave the reserve between now and the end of June, with 2 million barrels released over the last two weeks.

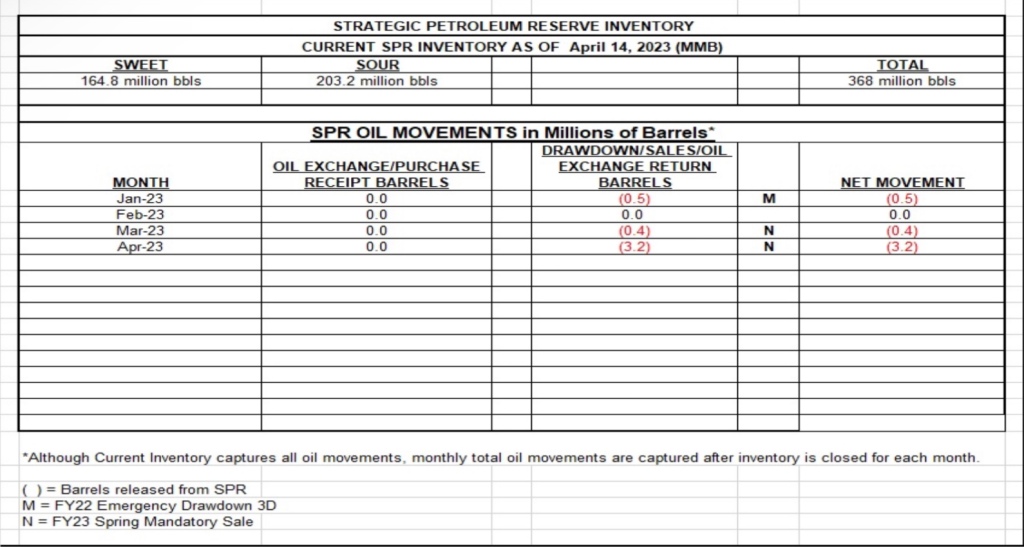

After the recent releases from the Strategic Petroleum Reserves, inventories in the nation’s reserves have sunk to 369.6 million barrels—down from 638 million barrels at the beginning of 2021, and the lowest amount of crude oil held in the stockpiles since November 1983.

If the United States and its allies impose sanctions on China, this could be the greatest financial mistake in all of modern history. Unlike Russia, China is more resilient and has deeper ties across the global economy. Punishing China will likely backfire against the dollar and unleash a de-dollarization wave that could knock it off the reserve status. Here’s what you must know!

Sanctioning China Will Destroy The Dollar | America’s Ultimate Mistake via Sean Foo

Related:

One Year After Russia Mega Sanctions, Senate Asks ‘Can We Do Same To China”

Goldman Sachs Warns Of An Imminent Oil Supply Shortage

According to Currie, rising demand from China and sanctions on Russian oil will contribute to the deficit, which he expects to manifest in the second quarter of this year. In response, producers will tap their spare capacity, leaving it lower than it was before. Eventually, this will lead to a serious imbalance between supply and demand.

The Biden administration plans to sell more crude oil from the Strategic Petroleum Reserve, fulfilling budget directives mandated years ago that it had sought to stop as oil prices have stabilized.

US to Sell 26 Million More Barrels From Strategic Oil Reserve

Washington Has Trouble Refilling The SPR After 220 Million Barrel Draw

After drawing over 221 million barrels of oil from the Strategic Petroleum Reserve (SPR) in 2022, Washington is having a tough time refilling it in the New Year, with the Department of Energy (DoE) rejecting the first offers on the grounds that they failed to benefit taxpayers.

…

Additionally, the Wall Street Journal speculates that the DoE may not have enough funding to refill the SPR completely. According to WSJ, the DoE has $.48 billion in purchasing power. At the desired $70 per barrel, that would give it enough funding to refill the SPR to 440 million barrels.

After two weeks of silence in detailing how it would react to the G7 oil price cap, overnight the Kremlin raised the stakes for the west when state-run Tass news service quoted Deputy Prime Minister Alexander Novak as saying that Russia may reduce output by 500,000 to 700,000 barrels a day in response to the cap.

Oil Prices Jump After Russia Says It May Cut Production

You must be logged in to post a comment.