Data-mining company Palantir is poised to turbocharge its sales to the U.S. military under President Donald Trump, amid signs that his administration plans to loosen the hold of traditional defense contractors and tap Palantir executives for key government positions.

Tag: Senate Banking Committee

Sanctioning China Will Destroy The Dollar | America’s Ultimate Mistake

If the United States and its allies impose sanctions on China, this could be the greatest financial mistake in all of modern history. Unlike Russia, China is more resilient and has deeper ties across the global economy. Punishing China will likely backfire against the dollar and unleash a de-dollarization wave that could knock it off the reserve status. Here’s what you must know!

Sanctioning China Will Destroy The Dollar | America’s Ultimate Mistake via Sean Foo

Related:

One Year After Russia Mega Sanctions, Senate Asks ‘Can We Do Same To China”

Evidence Grows that Crypto and Federally-Insured Banks Are a Combustible Mixture

The fallout from the collapse of the crypto exchange FTX and its missing billions of dollars of customer funds has, finally, galvanized some members of Congress to push back against the swarms of crypto lobbyists whose activities are clearly impacting the safety and soundness of U.S. banks.

Evidence Grows that Crypto and Federally-Insured Banks Are a Combustible Mixture

A Fossil Fuels Giant Has Been Raising the Election Chances of Extreme-Right Candidates — Using a Dangerous High-Tech Weapon

The Federal Election Commission (FEC), a federal agency, states that its mission is to “protect the integrity of the federal campaign finance process by providing transparency and fairly enforcing and administering federal campaign finance laws.” So last week Wall Street On Parade sent an email inquiry to the FEC, asking the following:

A Fossil Fuels Giant Has Been Raising the Election Chances of Extreme-Right Candidates — Using a Dangerous High-Tech Weapon

China getting rid of US debt holdings amid Washington DC’s escalatory actions and overall US decline

This year marks exactly 50 years since the establishment of ties between the United States and the People’s Republic of China. US President Richard Nixon visited China in 1972 and initiated an unprecedented thaw in relations, the first ever between a Communist power and a leading capitalist one. It was a very unusual occurrence, especially as the (First) Cold War was reaching its zenith precisely at that time. Although Mao Zedong himself and Nixon paved the way for the establishment of this relationship, it was only after Deng Xiaoping took power that the modern Sino-American relationship grew and in many ways shaped the economic and geopolitical realities of our time.

China getting rid of US debt holdings amid Washington DC’s escalatory actions and overall US decline

Related:

US debt held by China drops to lowest in 12 years

Speaking at a Senate Banking Committee hearing, Federal Reserve Chairman Jerome Powell acknowledged that the recent battle with inflation could tip the country into another recession.

Follow the Money Behind Senator Pat Toomey and His Boycott of the Vote on Fed Nominees

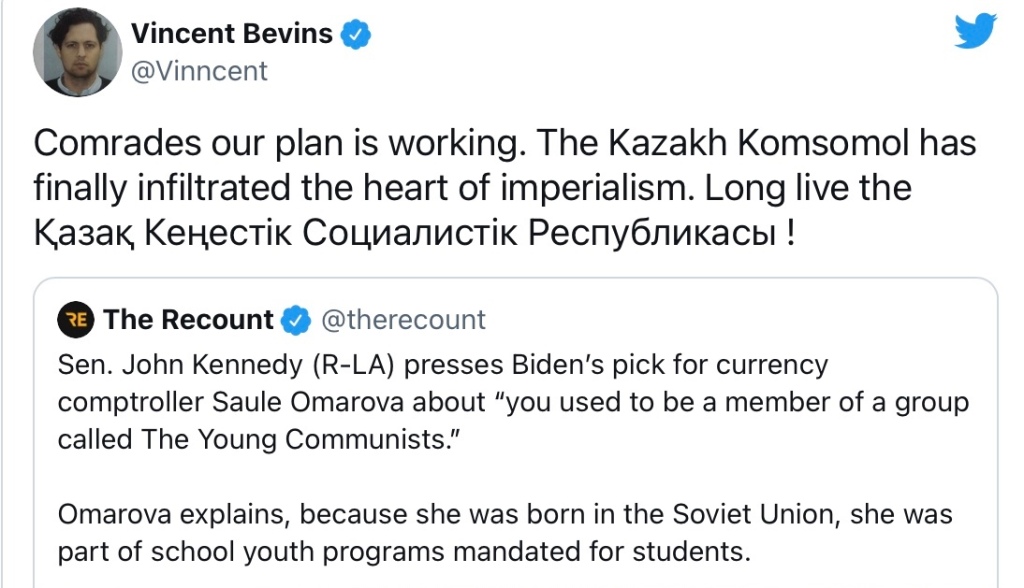

Biden’s pick for bank regulator grilled over Soviet past

Fed Chair Powell Misleads House Hearing on Wall Street’s Bailout Programs

Fed Chair Powell Misleads House Hearing on Wall Street’s Bailout Programs

It’s factually incorrect for the Fed Chairman to say that it can only make emergency loans with the approval of the Treasury. Months before there was any case of COVID-19 anywhere in the world the Fed was making hundreds of billions of dollars a week in emergency repo loans to Wall Street trading houses. The emergency loans started on September 17, 2019 – four months before the first reported case of COVID-19 in the United States. By January 27, 2020 the Fed’s ongoing cumulative loans to bail out Wall Street’s hubris tallied up to an astounding $6.6 trillion. (See Fed Repos Have Plowed $6.6 Trillion to Wall Street in Four Months; That’s 34% of Its Feeding Tube During Epic Financial Crash.)

Senate Banking Committee Sets GameStop Hearing for Tuesday; Koch Money Pops Up Again

GameStop Promoter Keith Gill Was No “Amateur” Trader; He Held Sophisticated Trading Licenses and Worked in the Finance Industry

While some hedge funds like Melvin Capital have reportedly lost billions in the short squeeze, other major players on Wall Street have made windfalls. Reuters is reporting that the giant asset manager, BlackRock, “owned about 9.2 million shares, or a roughly 13% stake, in GameStop as of Dec. 31, 2020,” and could have made upwards of $2.4 billion on the rise in the stock since the end of December. Gill also frequently mentioned on his YouTube videos Michael Burry’s long position in the stock as well as Ryan Cohen, whose RC Ventures held a 13 percent stake in GameStop.

Related:

‘Big Short’ investor Michael Burry made a 1,500% gain on GameStop during its Reddit-fueled rally

Along with Chewy cofounder Ryan Cohen, Burry has been agitating for changes at GameStop for a while. The Scion boss penned a letter to the company’s directors in August 2019, arguing the low stock price and massive short interest suggested a lack of faith in management, and calling for a massive share buy-back.

You must be logged in to post a comment.